Home Sales and Mortgage Originations

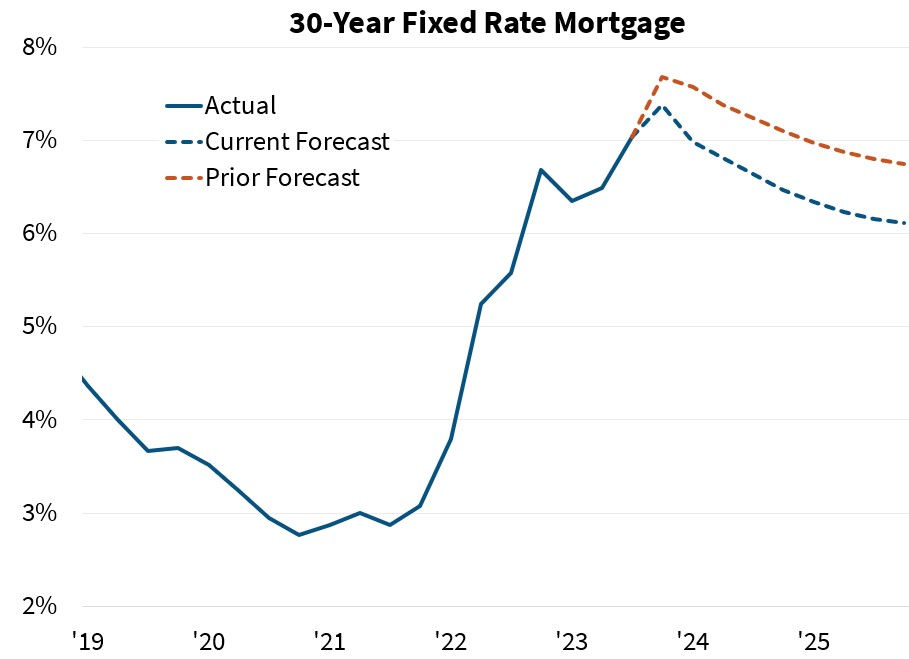

In 2024, a slow but meaningful recovery is expected in the real estate market, specifically in single-family home sales. The recent pullback in mortgage rates is anticipated to contribute to this upturn. Despite rebounding purchase mortgage applications, challenges such as affordability issues and limited housing inventory are likely to persist. The Economic and Strategic Research (ESR) Group forecasts a modest downturn in 2024, with a return to growth in 2025. Economic concerns, including stretched consumer spending and the effects of restrictive monetary policies, contribute to a slightly negative growth forecast for the year.

Employment and Manufacturing Activity

Employment gains are projected to remain strong in 2024. Nonfarm payroll employment rose by 216,000 in December, although job gains for October and November were revised downward. The unemployment rate was constant at 3.7%, but the decline in the labor force participation rate suggests potential challenges in workforce engagement. Manufacturing activity, as measured by the ISM Manufacturing Index, is still below the expansionary threshold of 50, indicating ongoing challenges. The Federal Reserve's minutes suggest a cautious approach to monetary policy, with a downward revision of the baseline target range for the federal funds rate.

Consumer Optimism About Mortgage Rates

Consumer optimism regarding mortgage rates has significantly increased, contributing to a rise in the Fannie Mae Home Purchase Sentiment Index (HPSI). A survey-high 31% of consumers anticipate mortgage rate declines over the next 12 months. Despite overall pessimism about homebuying conditions, the HPSI indicates a slight improvement in sentiment. Homeowners and higher-income groups express greater optimism about mortgage rate declines than renters. This optimistic outlook may signal an expectation of easing home affordability pressures in 2024, potentially influencing homeowners to list their homes for sale.

Conclusion

The 2024 real estate projection is poised for a cautious and modest recovery, marked by slow but meaningful improvements in home sales and mortgage originations. Persistent challenges such as affordability, interest rates, and economic conditions will continue to influence the overall trajectory of the real estate landscape. The employment sector remains resilient, although manufacturing activity faces ongoing challenges. Consumer optimism about mortgage rates suggests a potential positive shift in homebuying sentiment, contributing to a more optimistic outlook for the real estate market in the coming year.

Comments